Why Non-Conscious Measurement Should Be Mainstream Market Research (Find Out at GreenBook's Webinar)

Implicit Skepticism

The Scene [paraphrased]: In a conference room, with a VP of Insights at a Fortune 50 company, circa 2011 (ages ago in the advancement of behavioral-science-based market research applications):

Me: “So in a nutshell, we’re quantifying the degree of emotion associated with the brands, and then combining that data with consciously reported preferences to more accurately predict sales.”

Client: “Cool. This is really sexy. And I can see how this would work within your fashion example. But I’m not selling something sexy.”

Me: “What do you mean, exactly?”

Client: “How about a hammer? Would your implicit technique add to the predictive accuracy of a study forecasting hammer sales?”

Me: “Yes, the target audience for hammers would have different emotional associations for the hammer brands, and the product attributes of the hammer, like the comfort of the grip, the size of the head and the weight of tool. Measuring those emotional associations and combining them quantitatively with the reason-based trade-offs that the hammer buyers deem important would improve the predictive accuracy of that sales forecast model.”

Client: “I’m not convinced. It’s just a hammer. This is not an emotional decision.”

Me: “I can see why you’re skeptical. Let’s test it. What product within your suite would be akin to the sale of a hammer?”

Client: “Hot cereal.”

Me: “Great! Give us a call when you have a hot cereal study and we’ll run the test.”

Client: “Okay–but I’m not buying it.”

Me: “Fair enough, give us a call and we’ll put it to the test.”

If you’ve gotten this far and you’re not convinced, or want to learn more, the easiest thing to do is to join us Thursday, April 9 at 1 p.m. (EST) as we participate in GreenBook’s NIMF Webinar: Measuring Nonconscious Impact and the Application of Neuroscience. We’ll explain a lot of this and more.

The Hot Cereal Hypothesis

Two months later–I get the ping in my email.

“Hey Aaron, we’ve got on opportunity to test out the hot cereal hypothesis. We want to test which products at different pack sizes are going to be the most successful at Walmart next winter.”

“Wonderful. Let’s partner on this. We’ll run the study this quarter, you provide the actual sales data next quarter, and we’ll let the data tell us whether emotional associations matter in something as ho-hum as hot cereal sales.”

The Proportion of Emotion Model

So together we did it. Sentient designed a choice based conjoint study to reveal System 2 reflective preferences, and an implicit association study to reveal System 1 automatic associations.

We then integrated these two distinct data sources into a theoretically based, scientifically sound, and peer reviewed published model of how emotion serves as a weighting mechanism within a cognitive decision making algorithm: The Proportion of Emotion Model (Reid & Gonzalez-Vallejo, 2009).

Our partner client provided the product specs for the design before the study and the sales data for analysis the quarter after the study was complete.

System 1 + System 2 Data = The Best Insights

Once the study was complete, we compiled our combined System 1 and System 2 market forecast model, and, with our emotionally weighted simulator, made our predictions on what products and pack sizes would be the most successful and to what degree.

When winter rolled around, we asked for the sales data to see how accurate the leading indicator predictions were.

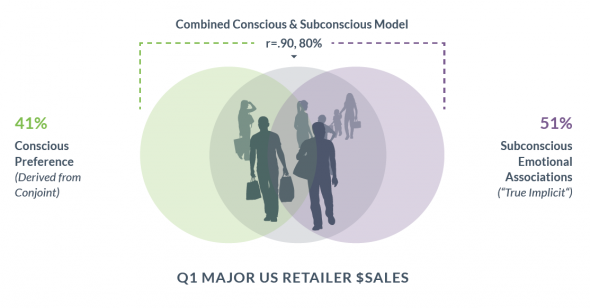

We compared three models:

- Data derived from conscious reflection in the conjoint (Expected Utility Model)

- Data from the implicit emotional (similar to Damasio’s winner-take-all Somatic Marker hypothesis)

- A combined System 1 and System 2 data model (the Proportion of Emotion Model).

How do you suppose this turned out?

1. The simple conscious model (System 2) accounted for 41% of actual in-market sales of hot cereal.

2. The implicit emotion model (System 1) accounted for 51% of actual in-market sales of hot cereal.

3. The combined System 1 and System 2 model accounted for 80% of actual in-market sales.

It turns out that even decisions about hot cereal are more accurately described by a combined System 1 and System 2 measurement model.

Combining Systems 1&2 thinking to predict oatmeal sales? The future is here. #TMRE14 pic.twitter.com/SUG4bMaiLS

— THE Grape Ape (@douglas_healy) October 21, 2014

From Dates to Diamonds to Diapers

Over time we have amassed hundreds of examples based on hundreds of millions of subconscious association measures that replicate and validate these kind of predictions. We’ve seen the quantification of non-conscious processing increase the predictive accuracy of:

- Choice of Dating partners

- Preferences for Diamond rings

- Volume of Diaper purchases

Beyond mate selection and procreation markets, the measurement and integration of isolated implicit association data has lead to increased accuracy in predicting:

- Financial risk decision making

- Furniture sales

- Bedding promotion success

- Coffee sales

- Ice cream market share

- Salty snack coupon redemption

And on and on and on…

How Do We Cross the Chasm?

This story and these case studies beg the questions that Lenny Murphy of GreenBook keeps asking based on the results of the semi-annual GRIT report: Why don’t we see the adoption of non-conscious research methods increasing year-over-year? What will it take for non-conscious measures to move into the mainstream?

This story and these case studies also provide what I consider to be the primary keys to broader industry adoption of non-conscious measures.

More Implicit Market Research Case Studies

First, as an industry we need greater commitment to the publication of case studies illustrating the business benefits of measuring the non-conscious. These can include increasing predictive accuracy of future consumer behavior–such as the hot cereal study above, but can also include among many others:

- Optimal trim of 30 second ads to 15 second spots (direct ROI from EEG and Biometrics applied to advertising testing)

- Increasing promotion effectiveness (as measured through coupon clip and redemption rates)

- Novel insight on how to subconsciously separate your brand from competition in the marketplace

- Revelation of new motivational drivers of behavior within a competitive category

As more case studies emerge, with clear demonstration of business benefits, insights professionals will move faster to incorporate non-conscious measures into their toolbox.

Is It Really Implicit?

Second, we need to establish clear definitions and a universal industry understanding of which methods provide true measures of non-conscious impact. We have written extensively on this topic, but it is important to emphasize again here.

If the measure isn’t a true implicit measure, it is not likely to produce results that will provide novel insight and increased predictive accuracy. As we demonstrated in the hot-cereal hypothesis study, using a “fast explicit” technique, does not provide the same novel insight and additive predictive accuracy as a true implicit association measure.

There are many providers in the industry offering good conscious measures dressed up as non conscious measures, and the more these measures are allowed to parade as the real thing, the longer it will take for the real thing to gain greater market adoption.

It’s not just the providers of true non-conscious measures that suffer from this parade of pretenders, rather it is business as a whole that suffers from the gradual stunting of growth in true non conscious measurement techniques.

Arriving at a Holistic Model of Consumer Behavior

Third, it is not enough to simply measure the non-conscious impact of marketing and assume that we have the whole answer. We need both conscious and non-conscious measures to be able to produce a holistic model of consumer behavior.

There are actually three components required for our industry to get this right:

- Use the most advanced choice models to assess conscious deliberation (System 2 thinking). Simply asking a purchase likelihood question or an agree/disagree explicit rating scale, isn’t going to cut it. Use trade-off based approaches (e.g. Conjoint, MaxDiff, Forced Ranking etc.) and derive the insight on Consumer System 2 reflective preferences through the observation of those trade-offs.

- Use a representative, quantitative implicit method to assess non-conscious associations (System 1 thinking). These methods might include implicit association, biometrics or neuromethods depending on the scale of your markets and the scope of your projects. However, these methods should not include “fast explicit” techniques if you hope to maximize the novel insight you will get above and beyond your other conscious techniques.

- Use a theoretically sound and scientifically validated model of how to integrate System 1 and System 2 data into a single predictive model of consumer behavior. It’s not enough to just measure System 1 and System 2 and then qualitatively compare the results, or quantitatively combine the data sources with equal weighting.

If consumers aren’t integrating these processing inputs into their decision making in these ways, we can’t expect a model that treats those information sources in that way to better predict their behavior. Furthermore, there’s no need to just “make up your own model.” There are models within the behavioral science literature than can be efficiently applied to your data. The Proportion of Emotion Model is one example.

It is the combination of these three components that will lead to the most predictive and reliable holistic models of consumer behavior.

- We’ve seen leading implicit measures combined with extremely poor explicit measures fail to provide insight.

- We’ve seen models that include great explicit measures combined with poor implicit measures fail to provide insight.

- And we’ve also seen great explicit measures and great implicit measures fail to be combined within a valid model and therefore fail to provide the kind of clear and compelling insight required to influence business decisions.

But every time we see advanced conscious measures, combined with true implicit measures within a scientifically valid model, we have seen direct business impact and broad organizational adoption of the insights.

If this three step integrated approach can double the predictive accuracy over current conscious measurement within the realm of hot cereal sales, imagine what it can do within your emotionally charged category. Better yet, you don’t have to just imagine it anymore–the tools are here, and the scientific models are sound–let’s do it together and move the market research industry forward!

Want to learn more?

Don’t forget to join us Thursday, April 9 at 1 p.m. (EST) as we participate in GreenBook’s NIMF Webinar: Measuring Nonconscious Impact and the Application of Neuroscience.