Brand Equity & Psychological Barriers to Competition

Brand Name vs. Brand Asset

Almost all products have a brand name but few reflect a brand asset. In other words, I can invent a better can opener and give it the brand name “Widget,” but does the Widget brand itself hold any value that’s useful and available to my company?

Most would say that the Widget brand has value because of all the great benefits the can opener provides, but that sort of value is a result of product R&D combined with my patents, so it’s not really brand value, per se.

Most would say that the Widget brand has value because of all the great benefits the can opener provides, but that sort of value is a result of product R&D combined with my patents, so it’s not really brand value, per se.

If, after 10 years of Widget sales my patent goes away, allowing competitors can create a similar can opener, the value attributable to my design may be depleted but not the value of the brand.

John Stuart, former Chairman of Quaker famously said, “If this business were to be split up, I would be glad to take the brands, trademarks and goodwill and you could have all the bricks and mortar–and I would fare better than you.”

Most marketers agree with Stuart’s perspective, but why is this statement true? What is the nature of a brand’s value over and above the value created by other more tangible assets in the firm?

Value is Economic

To begin with, there is only one way we know of to create economic value–by having more demand than supply.

So marketing has only two potential functions:

1) Stimulate Demand

2) Limit Supply

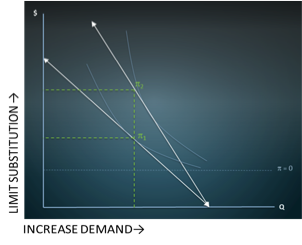

While it is a critical ingredient, all the demand in the world is insufficient and only commoditizes if not accompanied by a strategy to limit substitutability. A profit pool is only established when supply is limited; when there are enough competitive barriers to allow a firm to increase price without losing business. (see Fig. 1 – Reducing Elasticity)

Competitive barriers can have many faces, for example:

- Ownership of proprietary technology or patents

- Buying up excess capacity

- Making it difficult for competitors to enter/operate in a market

- Negotiating exclusive contracts with distributors or 3rd-party retailers

These are some of the most sure-fire tactics, but we typically think of these tangible, supply-side barriers as functions of the general manager vs. the marketer. When the nature of a firm’s point of difference is capital-based or tangible, while a brand name is frequently used, the brand itself is typically not a large contributor to the firm’s value.

What is Unique About Brand Value?

There is only one type of barrier that is specific to brand marketing, in that it cannot be credited to other departments: an intangible barrier.

Instead of limiting a competitor’s actions, intangible barriers work from the demand-side of the equation, effectively achieving a “voluntary reduction in supply” by preventing substitution. Hence, brand value is the result of intangible points of difference that create psychological barriers to competition, pricing power & profits.

[Note: Because businesses are most often initially formed by establishing tangible barriers to competition, managing the intangibles of brand marketing is observed to a much greater degree in well-developed markets.]

Measuring Brand Equity

Is there such a thing as intangible value? Let’s hope so, because there are over 1,000,000 full-time employees in the U.S. alone being paid to create, sustain & manage brand equity. However, the notion of measuring Brand Value, or Equity can mean a couple of different things:

Backward-looking: quantify the amount of a previous period’s brand’s premium attributable to intangible substitution barriers?

Forward-looking: quantify the amount of available pricing power provided by intangible substitution barriers?

Historically, measuring these things has been difficult if not impossible, yet today Sentient Prime™, the world’s most advanced implicit technology is able to effectively quantify the intangible reasons for choosing/not-choosing a brand across a projectable sample of the population. Here are some examples of intangible barriers:

Less Insulated

- Cognitive Access: it’s the first/only comes to mind related to a particular need

- Switching Cost: the convenience of implicitly trusting past positive experiences vs. the perceived effort or risk of trying something new

- Past Experiences: associations with family, culture, early experiences

More Insulated

- My Identity: reinforces what makes me feel unique and valuable

- My Ideals: reflects a choice for what I believe in and/or choice against what I oppose

- My In-Group: signals my connection with & belonging to a specific group

Why Do We Care?

We all want consumers to choose our brand… and the firm wants to capitalize on that desire by charging a premium. The purest demonstration of a brand’s value is the total incremental revenue I make by selling the same or greater quantity at a premium price when the competitors’ version of the same can opener is sitting right next to my “Widget” on the shelf.

However, if we don’t know our brand’s value or “equity”, we can make the mistake of charging a premium that is un-supported, in which case, we increase price, sell less product and lose share. This is not shifting demand, it’s moving up and down our existing demand curve, and as a colleague of mine once posited, “That’s not marketing, that’s accounting!”

As fundamental as this is to business, brand marketing has lately been coming under great scrutiny. With slow economic growth, the emergence of big data and bestsellers like “How Brands Grow,” many are questioning whether brand equity is a reality. The problem is that the hunger for empirical evidence is causing many to ignore the irrationality in human decision-making, perhaps because it cannot be seen in syndicated data or surveys.

The answer is neither entirely in the tangible or intangible, but both. Brands thrive for different reasons, and it’s important to have a complete view of competitive insulators to understand the true nature of our strategic advantage, whether it can be measured by bean-counters or behavioral scientists.

Ultimately, the good news is that these intangible barriers are translated to tangible value every day in categories from cars, to cooking oil, to computers, where brands enjoy an average of a 30%+ price premium relative to alternatives that are of indiscernible quality, and sometimes are actually identical products made by the same company, in the same factory, with a different label. To see the evidence of this, we need not look further than our own garages & cupboards

Value is not only economic.

Is there such a thing as intangible value? – All value is perceptual, subjective and intangible